THIS IS AN IMPORTANT SECTION.

PLEASE READ IT AND MAKE SURE THAT YOUR SHIPPING AND TAXES ARE SET UP CORRECTLY.

Otherwise, you may not be able to sell to certain destinations or collect corresponding shipping fees and taxes.

Note: at this point Ymart does not process sales outside of Canada and the USA.

How prices and shipping work on Ymart

There are two scenarios: when you have no Store set up & when you have your Store set up

No Store set up

Good news, you can keep it simple by using simplified listing default setup. The price which you enter in a product listing assumes that:

- Your products are available for sales anywhere in Canada and the USA.

- This price includes shipping fees to any province or state.

- Sales taxes for sales within Canada will be additionally added at the checkout.

- No taxes or custom fees will be added for sales to the USA.

If you happy with this setup you can just leave it like this

Note: It is your responsibility to collect and pay taxes correctly. Consult with your accountant and make sure tax setup meets your requirements.

- If you want to be more sophisticated you can change this default setup by going to Additional Information in the product listing. In "Shipping Cost" dropdown you can change "Free" (which is the default option explained above) to ether "Pick Up", "Per single item", or "For total quantity in order".

- Select your Shipping destinations: if you choose "Per single item", or "For total quantity in order" the default "ship to everywhere" setup is void and you have to select provinces and states where you ship. No orders will be processed to the provinces/states which you have not selected.

- Define shipping rates: if you choose "Per single item" or "For total quantity in order" you also can enter shipping rates for the destinations you select to ship to. The shipping fees will be calculated as following:

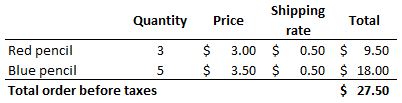

1. Per single item: shipping rate will be multiplied by the quantity of the product in the order. Different products are treated individually in the order. Example:

.jpg)

2. For total quantity in order: shipping rate will be entered only once per each product in the order regardless the quantity. Different products are treated individually in the order. Example:

You have you Store set up

- You can set up universal shipping and tax rates in Shipping & Taxes tab which will be applied as default rates to all your product listings.

- If you choose to set up universal shipping and tax rates you MUST enter the rates for each province/state where you ship. If you do not provide rates Ymart will assume they are zero.

- If required, you can overwrite these default setup for selected products by making changes in Additional Information in each individual product listing. The rates you see in Additional Information in each individual product listing are the rates which are in use for this listing.

- Similar logic as explained above (No store set up) applies to setting shipping and tax rates:

- Select your Shipping destinations: you have to select provinces and states where you ship. No orders will be processed to the provinces/states which you have not selected.

- Define Shipping and Tax rates: you can enter shipping and tax rates for the destinations you select to ship to. If you leave cells blank no shipping fees and taxes will be applied to the orders.

Important:

- Each time you post new product the default "Free" shipping everywhere logic applies.

- To use your Store shipping rates, please go to Additional Information in product listing and change Shipping Cost from "Free" to either "Per single item" or "For total quantity in order". Store shipping rates can also be overwritten here for a specific product listing.

- Store shipping and tax rates DO NOT apply to the listings created before Store setup. Shipping fees and tax rates for these listings can be managed by using options in product Additional Information section.